Why Dollar Buy Sell Awareness Is Critical for Smart Traders

Wiki Article

Understanding the Essentials of Buck Get Offer: An Overview for Savvy Traders

Navigating the complexities of buck get and sell deals needs a strong grasp of important principles. Savvy investors must comprehend currency pairs, pips, and the myriad variables that affect the buck's worth. By incorporating basic and technical evaluation with effective danger monitoring, traders can improve their decision-making. Numerous forget crucial techniques that can substantially influence their end results. Exploring these strategies might reveal chances that could alter the training course of their trading journey.The Essentials of Currency Trading

Currency trading, frequently described as forex trading, involves the exchange of one money for an additional in the global market. This market operates 24 hr a day, covering multiple time zones, and is among the biggest economic markets on the planet. Traders involve in currency trading to maximize variations in exchange prices, purchasing currencies they expect to value while offering those they expect will decrease.Secret concepts include money pairs, which stand for the worth of one currency versus another, and pips, the smallest cost motion on the market. Take advantage of is likewise an important element, allowing investors to manage larger settings with a smaller sized quantity of funding. Comprehending market fads and rate graphes is vital for making educated choices. Successful currency trading calls for threat, knowledge, and strategy monitoring, as the volatility of the foreign exchange market can lead to considerable gains or losses quickly.

Elements Influencing Dollar Worth

Numerous essential variables affect the worth of the U.S. buck in the global market. Economic indications, such as GDP development, work prices, and rising cost of living, play a substantial function in shaping understandings of the dollar's toughness. When the united state economic situation executes well, confidence in the buck increases, usually causing appreciation against various other moneyRate of interest rates set by the Federal Book are vital as well; greater rates commonly attract foreign investment, boosting need for the dollar. Furthermore, geopolitical stability and profession relations impact its value; unpredictability or dispute can lead to a weak buck as financiers look for more secure properties.

Supply and demand dynamics likewise influence the buck's value. For example, when even more dollars are in circulation without equivalent economic growth, the dollar may depreciate. Finally, market sentiment and speculation can drive variations, as investors respond to news and patterns influencing assumptions of the buck's strength.

Studying Market Trends

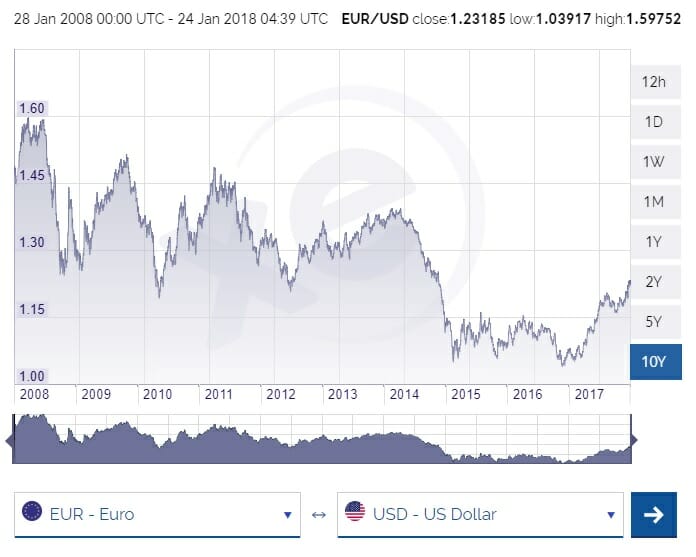

Comprehending market fads is essential for traders seeking to take advantage of fluctuations in the dollar's worth. Examining these fads includes analyzing historical information and existing market indicators to recognize patterns that may suggest future motions. Investors frequently use tools such as relocating standards, fad lines, and momentum indications to assess the dollar's performance about other money.In addition, economic records, geopolitical events, and central bank policies play a significant duty in forming market sentiment. A strong employment record could signify economic development, potentially leading to a more powerful dollar. Alternatively, political instability can create unpredictability, impacting the dollar negatively.

Techniques for Acquiring and Offering Bucks

While steering with the complexities of the forex market, investors should create efficient techniques for acquiring and offering bucks to optimize their profits. One common method is technological evaluation, where traders use historic cost information and chart patterns to forecast future movements. Dollar Buy Sell. This can involve determining assistance and resistance degrees or utilizing indications like relocating averagesFundamental evaluation additionally plays a vital role, as investors evaluate financial indications, rate of interest rates, and geopolitical occasions that can influence buck worth.

In addition, embracing a regimented trading plan aids investors define their entrance and leave factors, ensuring they act emphatically instead of emotionally.

Making use of restriction orders can assist investors get or sell dollars at predetermined rates, boosting performance. Ultimately, branching out money pairs can minimize exposure and raise possible hop over to these guys opportunities. By incorporating these strategies, investors can browse the buck market with greater confidence and efficiency.

Taking Care Of Dangers in Money Purchases

:max_bytes(150000):strip_icc()/GettyImages-1031084282-4fe5beeeed3f46e48426faaab5c53b3d.jpg)

Assessing Market Volatility

Market volatility plays a necessary function in currency purchases, affecting the choices investors make in the busy foreign exchange atmosphere. Recognizing market fluctuations is important, as these variants can greatly impact currency worths and trading techniques. Investors frequently analyze factors such as financial indicators, geopolitical events, and market sentiment to determine volatility. Devices like the Ordinary Real Variety (ATR) or Bollinger Bands might help in determining volatility levels, supplying insights right into prospective rate activities. Furthermore, acknowledging periods of increased volatility can enable investors to make enlightened choices, enhancing their capability to profit from opportunities while mitigating dangers. Ultimately, a detailed evaluation of market volatility is essential for reliable currency trading and danger management.Setting Stop-Loss Orders

To successfully manage risks in money transactions, investors usually implement stop-loss orders as a crucial device. A stop-loss order immediately causes a sale when a money gets to an established rate, minimizing potential losses. This strategy enables investors to set clear limits on their danger direct exposure, making it easier to comply with their trading plans. By establishing stop-loss degrees based upon market evaluation or specific danger tolerance, investors can protect their resources from abrupt market variations. Stop-loss orders can minimize psychological decision-making throughout unpredictable market conditions, ensuring that investors stay regimented. On the whole, including stop-loss orders right into a trading strategy is a prudent approach to protecting investments in the dynamic landscape of currency trading.Expanding Currency Holdings

Stop-loss orders act as an essential approach for risk monitoring, yet investors can furthermore enhance their protection by expanding their currency holdings. By spreading out financial investments throughout multiple money, traders can alleviate dangers related to money changes. This strategy enables them to maximize differing financial problems and geopolitical growths that may influence details currencies in a different way. If one currency drops, gains in one more can assist maintain general profile worth. Diversification can minimize direct exposure to currency-specific events, such as political instability or economic declines. Traders need to my company take into consideration factors such as liquidity, volatility, and relationship among money when building a diversified portfolio. Eventually, a well-diversified money strategy can result in more constant returns and reduced general risk.Tools and Resources for Traders

While steering via the intricacies of money trading, traders count greatly on a variety of devices and sources to boost their decision-making processes. Charting software is necessary, enabling investors to imagine cost activities and recognize fads. Real-time information feeds provide up-to-date market details, making it possible for fast responses to variations. Economic calendars, highlighting crucial financial occasions, assistance investors prepare for market shifts influenced by economic records.Furthermore, trading platforms geared up with analytical devices facilitate method growth and implementation. Numerous traders also make use of threat management calculators to figure out suitable setting sizes and prospective losses. Academic sites and on the internet discussion forums work as valuable resources for sharing understandings and methods within the trading community. Mobile applications offer the convenience of trading on the go, making certain that investors stay involved with the market at all times. In sum, an all-round toolkit is crucial for notified and calculated trading in the dynamic money market.

Often Asked Inquiries

published hereWhat Are the Trading Hours for Money Markets?

Money markets run 24 hr a day, five days a week. Trading starts on Sunday night and continues till Friday night, permitting participants around the globe to take part in trading at any moment.Exactly How Do Geopolitical Events Affect Buck Trading?

Geopolitical events considerably affect dollar trading by influencing financier view, altering supply and demand characteristics, and motivating changes in financial policy. Such developments can bring about currency volatility, affecting traders' decisions and market stability.What Is the Function of Reserve Bank in Currency Trading?

Reserve banks affect currency trading by establishing rate of interest, regulating cash supply, and intervening in fx markets. Their plans effect currency worths, capitalist confidence, and overall market security, making them essential in worldwide economic systems.Can I Trade Dollars Making Use Of a Mobile App?

Yes, people can trade dollars utilizing mobile apps. These platforms provide accessibility to real-time market data, help with transactions, and typically offer easy to use user interfaces, making currency trading accessible to a broader target market.Exist Tax Implications for Trading Dollars?

Tax obligation implications for trading dollars exist, as earnings may be subject to funding gains tax. Investors need to consult tax specialists to comprehend their particular responsibilities, consisting of coverage demands and possible reductions associated with currency purchases.Money trading, often referred to as foreign exchange trading, entails the exchange of one currency for another in the global market. Secret ideas include currency sets, which stand for the value of one currency versus one more, and pips, the smallest rate activity in the market. Managing risks in currency deals is necessary for traders maneuvering with the intricacies of the foreign exchange market. Market volatility plays a necessary role in currency transactions, affecting the choices investors make in the fast-paced forex atmosphere. By spreading out financial investments throughout multiple money, traders can reduce dangers connected with money variations.

Report this wiki page